In this section we will pass on a great deal of general information on; why to acquire gold or silver, how much gold or silver should you acquire, and what type of gold or silver should you acquire. Our ongoing commitment at Pugsley and Sons is to give as much information as possible, and then work with each client to apply what is applicable to their financial needs. While all of the following information is true and viable, all of it will NOT be applicable to the individual financial needs of our clients. So please review and we look forward to personally discussing your best options.

WHY BUY PHYSICAL GOLD & SILVER

Stability in Volatility

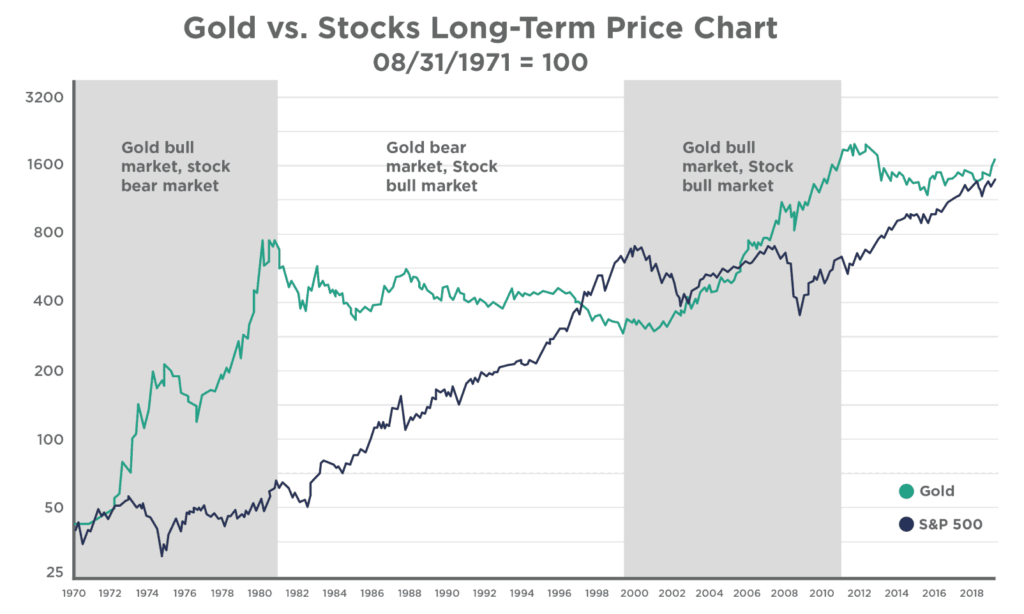

If you are concerned about the volatility of the stock market, you’re not alone. The extreme highs and lows of the stock market often lead investors towards safe-haven assets, like bullion. Historically, the Precious Metals market has an inverse relationship with the stock market, meaning that when stocks are up, bullion is down and vice versa.This inverse correlation holds firm even when the stock market has crashed. Though Gold and Silver don’t automatically rise with every fall in the stock market, history points to bullion as a hedge during stock market declines. Bullion allows you to be prepared for such catastrophes, providing you with a hedge against economic uncertainty.

Protect Your Investments

One of bullion’s strongest benefits is that it can protect your investments. Periods of economic, monetary, or geopolitical crises can wreak havoc on your portfolio. Bullion can allow you to use your investments in Gold and Silver as both a defensive tool against uncertainty and an offensive profit when other investments fall. Bullion is typically referred to in terms of defense because of its historical staying power; however, Gold and Silver can also be used as offensive strategies when building wealth. Gold and Silver offer substantial profit potential. When the world experiences unrest, and the market falls into crisis – putting our economic, fiscal and monetary systems at risk – bullion benefits. Investors look to Gold and Silver as safe-havens when fear strokes the market. The higher the apprehension, the higher the demand for safe-haven assets, the higher the price for Gold and Silver goes. With elevated risks on multiple fronts, Gold and Silver can offer a low-risk, high-reward investment option.

Metals hold value over time and provide wealth that can be securely passed down to future generations. Source: Visualcapitalist.com

Top Performing Asset Class

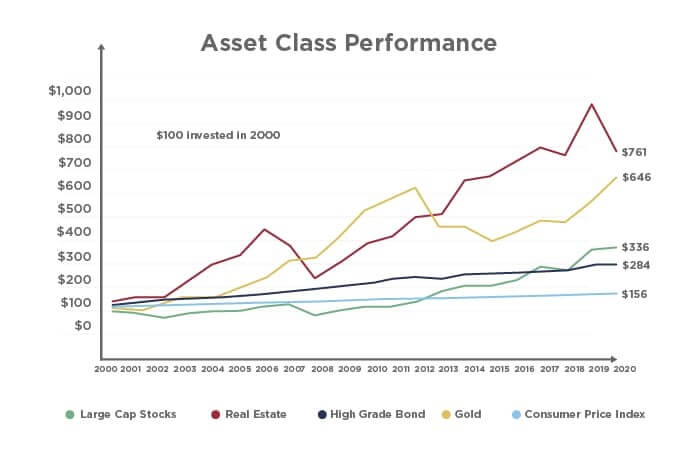

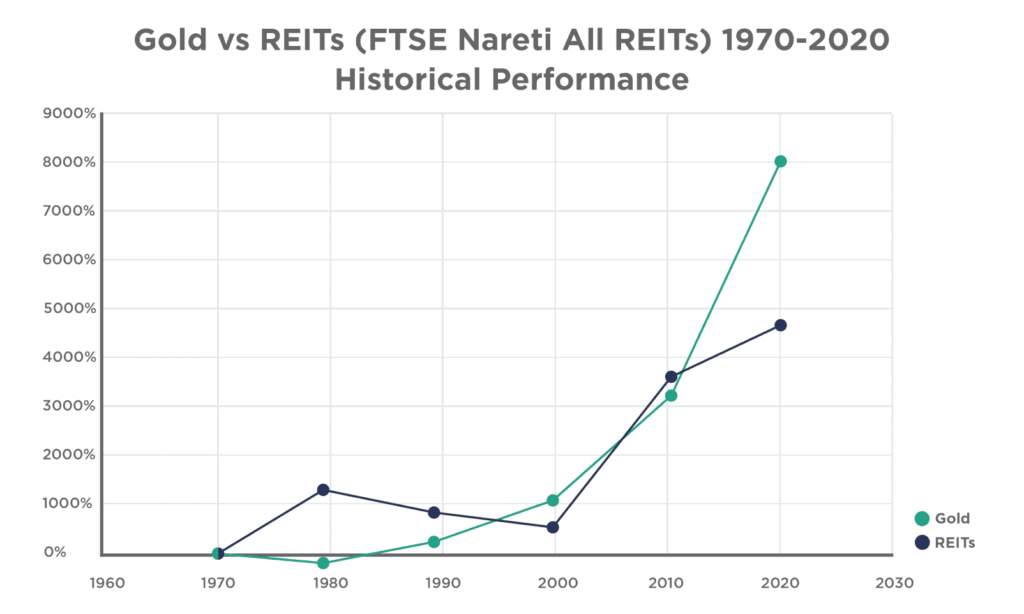

Though Gold is no longer used as currency in the modern world, the yellow Precious Metal has been a store of value for at least 3,000 years. Gold has been the second-best performing asset class since 2000, with annualized returns at nearly 8%, second only to real estate investment trusts with returns at 10%.

Because the global supply is relatively finite, Gold’s purchasing power has historically remained stable during inflationary times. Silver is also no stranger to longstanding value. Silver has been considered a precious element for over 6000 years. It was first used as a currency in 700 B.C. and has had a role as a trading metal in nearly every ancient and modern culture. Many find comfort in knowing that Gold and Silver have been recognized for their value throughout a great deal of humankind’s history.

Metals hold value over time and provide wealth that can be securely passed down to future generations. Source: OneGold.com

Supply and Demand

Since the 1990s, much of Gold’s supply in the market has come from Gold bullion sales from global central banks’ vaults. Because of the market crash in 2008, the rate at which global central banks were selling Gold slowed. The decrease of sales from global central banks coupled with the declining production beginning in 2000 increased the yellow metal’s price. As a general rule, a reduction in the supply of Gold increases the Gold price.

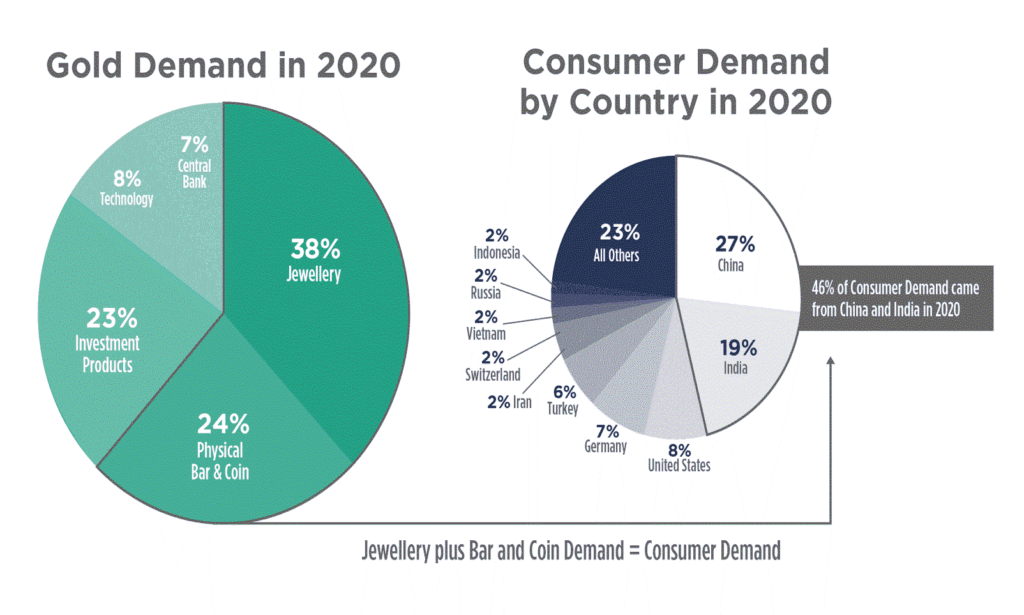

Despite its finite supplies, the demand for Gold has only grown. Gold is prevalent in many cultures, including China, where Gold bars are a conventional form of saving, and India, the second-largest Gold-consuming nation in the world. Demand for Gold has also grown among investors. Even during the COVID-19 pandemic, which ravaged the financial market, the Gold price returned 25% in 2020, supported by investor demand.

Due to advancements in medical science, technology and aesthetic preferences, Silver supply and demand has fluctuated a great deal through the centuries. Today, Silver’s demand is higher than ever because it is a crucial component of widely manufactured electronics, including computers, mobile phones and solar panels.

Global Silver production fell for the fifth consecutive year in 2020. The drop resulted from declining grades at several primary Silver mines and disruption-related losses at some major Silver producers. Much like Gold, Silver’s demand will likely continue to grow despite the limited supply.

According to the Silver Institute, Silver’s global demand will rise to 1.025 billion ounces in 2022; it’s highest in eight years. Silver has many uses, including industrial applications, like electric vehicles, solar panels, jewelry creation, medicinal uses and minting Silver investment products. Physical investment, which covers Silver bullion coin and bar purchases, is expected to achieve a six-year high in 2022 of 257 million ounces.

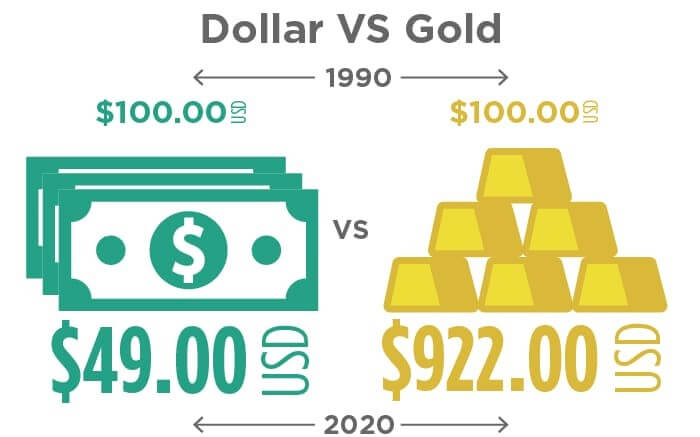

The value of the U.S. Dollar has steadily decreased over the last several decades, making an investment in Precious Metals more appealing to those who want to minimize the impact of inflation on their assets.

HOW MUCH PHYSICAL GOLD & SILVER SHOULD I HOLD

This question is one of the most important for investors to answer. After all, experts suggest limits on how much of any types of investments should go into a portfolio. After deciding to purchase and own Precious Metals and considering how much money to allocate, one can then think about how much and what to buy at any point in time…

What Experts Recommend for a Portfolio

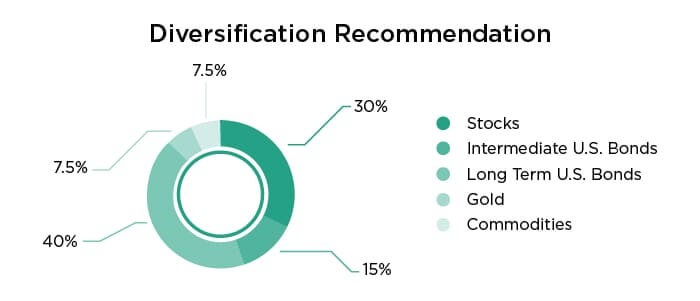

First and foremost, investors should consider the pros and cons of having Precious Metals in their portfolios, since how they view these points will dictate the amounts they should own. Below is a graphic that shows one recommendation for portfolio diversification. A general guideline is to dedicate 5% to 15% of an overall portfolio to Precious Metals, but this figure depends on several factors, including demand, expense and time and effort to spend.

Next, an investor should consider owning Precious Metals as a diversification strategy, along with varying their portfolio as they grow their asset base. Precious metals are non-correlated assets. That means that generally when the stock or bond markets are experiencing wild fluctuations, investors tend to prefer the safety and stability of precious metals. Also, an investor should consider planning to invest in Precious Metals to help build wealth over time, keeping in mind that needs and desires will change with time and other factors.

Pros and Cons of Precious Metal Ownership

As with any investment, investors must weigh several considerations and do their own research. Precious Metals have stood the test of time, having been around for more than 5,000 years, and will be here for years to come. The following information outlines the general pros and cons to owning Precious Metals. Pros:

Diversification: Precious Metals tend to perform inversely to equities, especially in more volatile times. Also, as the dollar has historically weakened in buying power, history has shown that Precious Metals have held their value or increased significantly. Precious Metals tend to do better than traditional “paper” investments, while an investment portfolio can decline when the market is underperforming; this is due to the almost inverse relationship the market and Precious Metals have. Unlike paper assets, precious metal values can never go to zero.

No Counterparty Risk: Instead of dealing with banks or other financial institutions to buy physical Precious Metals, one can utilize myself as the supplier. By utilizing me as your Physical Precious Metals Consultant, you are not wagering your investment on any broker, analyst recommendations or on any mining company operations. With my service, your whole investment is the precious metal itself and remember, no government reporting required while holding and acquiring certain precious metals

This chart shows the inverse relationship between Gold and the S&P 500. Source: Topforeignstocks.com

Hedge Against Inflation: Due to inflation, the purchasing power of the dollar tends to decrease over time. However, Precious Metals tend to hold their value with time, especially in the event of market downswings; thus, buyers are apt to turn to Precious Metals as assets that will maintain their value.

Privacy: Precious Metal ownership is a more personal investment than stocks or bonds. There is no reporting requirement when you purchase precious metals – no one knows that you have them. It is also a way to pass along a physical form of financial security to loved ones or give to future generations in an estate.

Long-Term Store of Value: Precious Metals are generally viewed as a viable asset, having held their historic value over the centuries. They have been used in bartering and backing currencies and are stored by leading world banks.

Proven Performance: Although history is no predictor for the future, Precious Metals have performed well since 2000, with Gold being the second-best performing asset class after real estate. Many investors do not generally take this fact into account, since they usually purchase safe haven investments during more unpredictable times in the marketplace.

This chart compares the overall historical performances of gold and real estate investment trusts (REITs) since 1970. Source: Scopemarkets.com

Intrinsic Value: Unlike some more recent investment vehicles, Precious Metals and their prices are driven by actual supply and demand. Precious Metal mining has become far more difficult and costly over time, while its uses continue to expand. Thus, the demand outweighs the supply, and their values continue to climb.

Worldwide Demand and Interest: Precious Metals serve an essential role in various countries and in many societies. Developing countries like India and China are significant consumers of Precious Metals. India’s gold demand, in particular, is “interwoven with culture, tradition, the desire for beauty and financial protection,” according to Somasundaram PR, the managing director for India in the World Gold Council. China encourages its citizens to buy gold for their future and China also limits the exportation of gold from within its borders.

WHAT TYPE of PRECIOUS METALS SHOULD I BUY

With the frequent changes in the market and countless Precious Metal products available, choosing the right bullion can be difficult. Some want Gold or Silver coins, rounds or bars while others want products that are valuable because of their design, mintage or other collectible qualities. Also, collectors may shop for unique sets and individual pieces for their collections.

When buying Precious Metals, an investor will incur a total cost that includes the spot, a premium and any applicable taxes and other fees. The spot price is the value of a Precious Metal at any given time, and a premium is the additional price paid over the spot price to help cover manufacturing and distribution costs.

Remember that both spot prices and premiums vary with time, market conditions, mintage and manufacturing. Though taxes and fees tend to stay constant, the spot price and premium will always fluctuate. Also, the smaller the weight bought, the larger the premium tends to be. Inversely, one might pay smaller premiums when buying larger amounts of Precious Metals.

Sovereign Bullion Coins

Sovereign coins are the most popular Precious Metals people buy for investment purposes. They are minted in quantities; they have face values like regular currency; and they historically maintain their values and premiums. Also, unlike bars and rounds, they are manufactured, backed by the full faith and credit of the underlying sovereign governments around the world, and they are quite transferable.

Another reason to buy sovereign coins is their ability to retain value over time. Unlike bars and rounds, which only have value due to their metal content, not only are the coins worth their face value, but they also have intrinsic value due to their metal content and collectability. Sovereign coins each usually have declared set mintages (supply), along with a strong market for their purchase and collection (demand). Due to the principle of supply and demand, putting these two factors together is a formula for longtime preservation of value.

Many investors obtain and hold onto these coins because of their recognizability and ease of liquidity – the ability to be converted to cash. But an additional reason to invest with the American Eagle is its transferability. Like all Precious Metals, it can be handed down easily to future generations or even left as part of an estate. But if an investor needs to sell American Eagles, there are thousands of coin dealers across the country looking to buy that exact item.

American Eagles are one of the few types of sovereign coins allowed by law to be used in individual retirement accounts, or IRAs, due to their backing by the U.S. Government. They serve as buffers against inflation and the volatility of the stock market and can be held in specialized plans called Precious Metals IRAs. These function the same as regular IRAs but only hold physical bullion coins or bars. Only selected products are eligible for those programs, since by law they must meet minimum content purity standards: Gold must be 99.5% (.995) pure, Silver must be 99.9% (.999) pure, and platinum and palladium both must be 99.95% (.9995) pure. However, Precious Metals IRAs are unique and have different regulations and custodians, along with limits to the annual contributions allowed to be made to them. We strongly suggests utilizing a Self Directed/Checkbook IRA or 401K (Additional information can be provided on a self directed Checkbook IRA/401K) Other popular products for first-time sovereign coin buyers include Canadian Maple Leafs, South African Krugerrands and Austrian Philharmonics.

Bars and Rounds

Bars and rounds are forms of bullion minted by private companies. They have the same general content and purity as sovereign coins minted by governments, but normally do not have the greater cost of production of coins. Thus, bars and rounds are a more cost-effective way to invest in Precious Metals. A major consideration when buying bars and rounds is paying premiums over spot. If an investor is only interested in weight and is not interested in the benefits and increased premiums of a sovereign coin like the American Eagle series, then private minted bars and rounds should be considered. When purchasing bars and rounds, due to the lower production costs, the premiums will be lower. I highly recommend the high quality of Scottsdale Mint when considering privately minted bars and rounds.

This chart shows the demand of Gold by country in 2020. Note the outsized demand by China and India together. Source: Talkmarkets.com